A Prelude to Tesla's Challenges: Ford’s Golden Age vs. GM's Rise in the 1920s

Lessons from the past as Tesla faces the giants of the industry

Back in 2017, Tesla launched the Model 3. If the Model S was the original iPhone, then the Model 3/Y was the iPhone 4. They were the first products in their respective category to gain wide adoption and propelled that category to the mass market. Today, the Model Y is the best selling vehicle of any kind in the world in 2023. The Model 3 is also also incredibly popular.

However, chinks are starting to form on Tesla’s armor. Tesla’s overall product lineup is aging. The Model 3/Y really hasn’t changed since first introduced back in 2017/19. Promised new products like the Cybertruck, Roadster, and even the Semi have seen delay after delay. The model 3 is 6 years old and is just seeing its first mid-cycle refresh. Traditional automakers typically do a major re-design every 6 years. In a competitive market like China, these mid-cycle refreshes happen every 18 months and major redesigns every 3 years.

The end result is that Tesla’s only lever to drive volume growth for the past year have been price. Its base models have seen price decline of ~15%. Its top of the line models have seen drop of 25%. For a company that prides itself in product innovation, the predicament they are in is rather ironic.

These price actions are hurting them financially as well. Despite growing delivery volume by 30% YoY, Q3 2023 revenue was flat and operating profit dropped by 52%. If you compared Q2-23 numbers (not impacted by factory shutdown) with Q3-22, delivery volume grew by 36%, but operating profit was 35% lower YoY.

History never repeats, but it often rhymes. Tesla today is in the same position as Ford back in the early 1920s. Both companies have built a disruptive product. The Model T at the time commanded 60%+ market share in the nascent auto industry. Tesla’s EV market share in the US is also similar.

A Quick Look Back At History

Model T was the undisputed champ in the nascent automobile industry. The Model T was first introduced in 1908, and Ford's market share surged from 9 percent to 62% percent in 1923, when it sold over 2M units/year.

At that time, I'm sure Ford and the general public all felt like the company was invincible.

The key to its success at the time was standardization. Henry Ford famously said, "Any customer can have a car painted any color that he wants, so long as it is black."

By keeping the cars highly standardized and offering limited options and interchangeable parts, Ford’s revolutionary assembly line replaced skilled craftsmen with ordinary unskilled laborers who worked one small task faster and more efficiently. This cut the labor hours by 60 percent. With lower costs, Ford was able to charge a price that was accessible to the mass market. In fact, between 1909 and 1925, Ford was able to cut the price of the Model T by a whopping 80%, while improving the performance of the product.

However...just 4 years after hitting peak volume, Ford had to end production of the model T, despite continuing to lower prices.

As the U.S. entered the Roaring Twenties, consumer tastes shifted towards more luxury, comfort, and style in cars. GM was quicker to respond to these preferences.

Under Alfred Sloan, GM began to emphasize car design, styling, and annual model changes, which attracted customers who wanted the latest features and styles. They introduced different brands catering to different income levels (e.g., Chevrolet, Pontiac, Oldsmobile, Buick, and Cadillac). This approach allowed GM to cater to a broader customer base with specific models for various needs and desires.

In contrast, due to Ford's initial success, the company was somewhat resistant to significant changes. As a result, Model T remained largely unchanged for almost two decades.

Ford eventually recognized the need for change, and introduced the Model A in 1927. However, to make the switch, Ford had to shut down production for several months, allowing competitors like GM to gain market share. While the product was still a success, Ford was no longer able to gain back its dominant position it held onto during the earlier part of the decade.

In short, I think the lessons learned during this period are:

Consumer’s basic needs are the same. But beyond that, consumer preferences vary dramatically.

Automobiles, while serving the basic need of efficient transportation, also have serve many higher level wants in the Maslow’s hierarchy.

Consumer preferences also change with time. A recipe that may have worked during one time wouldn’t necessarily work in another. For auto manufacturers with long investment horizon and product lifecycle, this is a massive challenge.

What does all this mean for Tesla?

Is Tesla doomed? Of course not. Ford’s subsequent Model A was still a commercial success. Today, Tesla is still the undisputed #1 EV brand globally. Its product, despite being 6 years old, are still very competitive. Their supercharging network is a massive moat that other companies do not have. They also have a very strong balance sheet and very little debt.

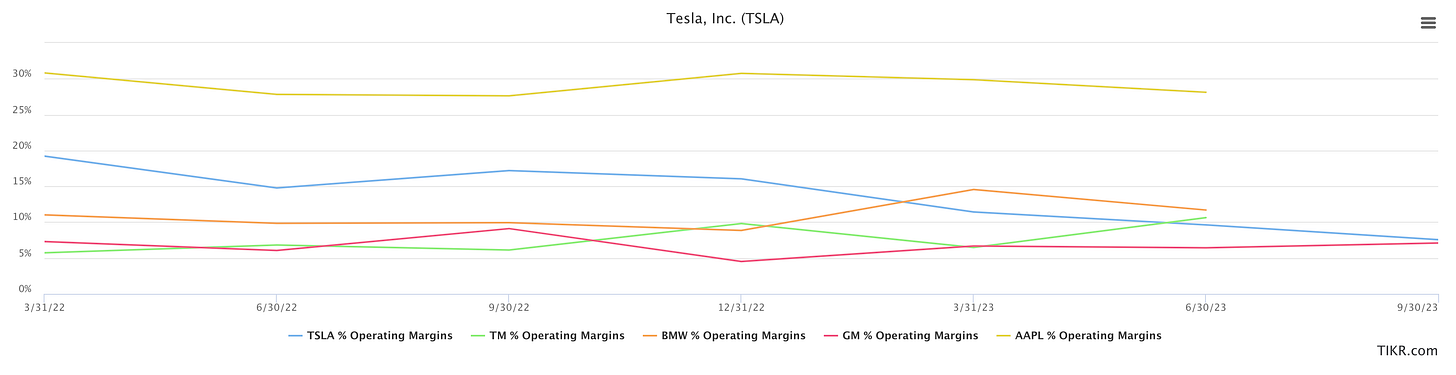

However, I believe people need to re-rate Tesla’s auto business. Without dramatic changes in its product strategy, its days of growing 50% YoY are over. The “operating leverage” narrative has also played out. The idea that they will have “Apple” like margin is imo a pipe dream. Going forward, their margin profile will look a lot more like GM’s than Apple’s.

All evidence points to them continuing to be a successful and influential auto manufacturer on the global stage. But at the end of the day, they are still an auto manufacturer. They are subject to the same market forces and will have to learn to deal with the challenges that all the other OEMs have learned to navigate over the years.