Bridging the Battery Divide: CATL's International Strategy to Electrify the Auto Industry

From Europe's production lines to U.S. licensing deals, how CATL is approaching its go to market strategy in the global EV industry

The electric vehicle (EV) market stands at a crucial juncture, with consumer preferences increasingly leaning toward more affordable and accessible options. The key enabler for affordability is the cost of the battery pack, which is the most expensive component of an EV. Currently, the price of a battery pack hovers around $100/kWh, equating the cost of a 100 kWh pack to that of a GM LS3 crate motor.

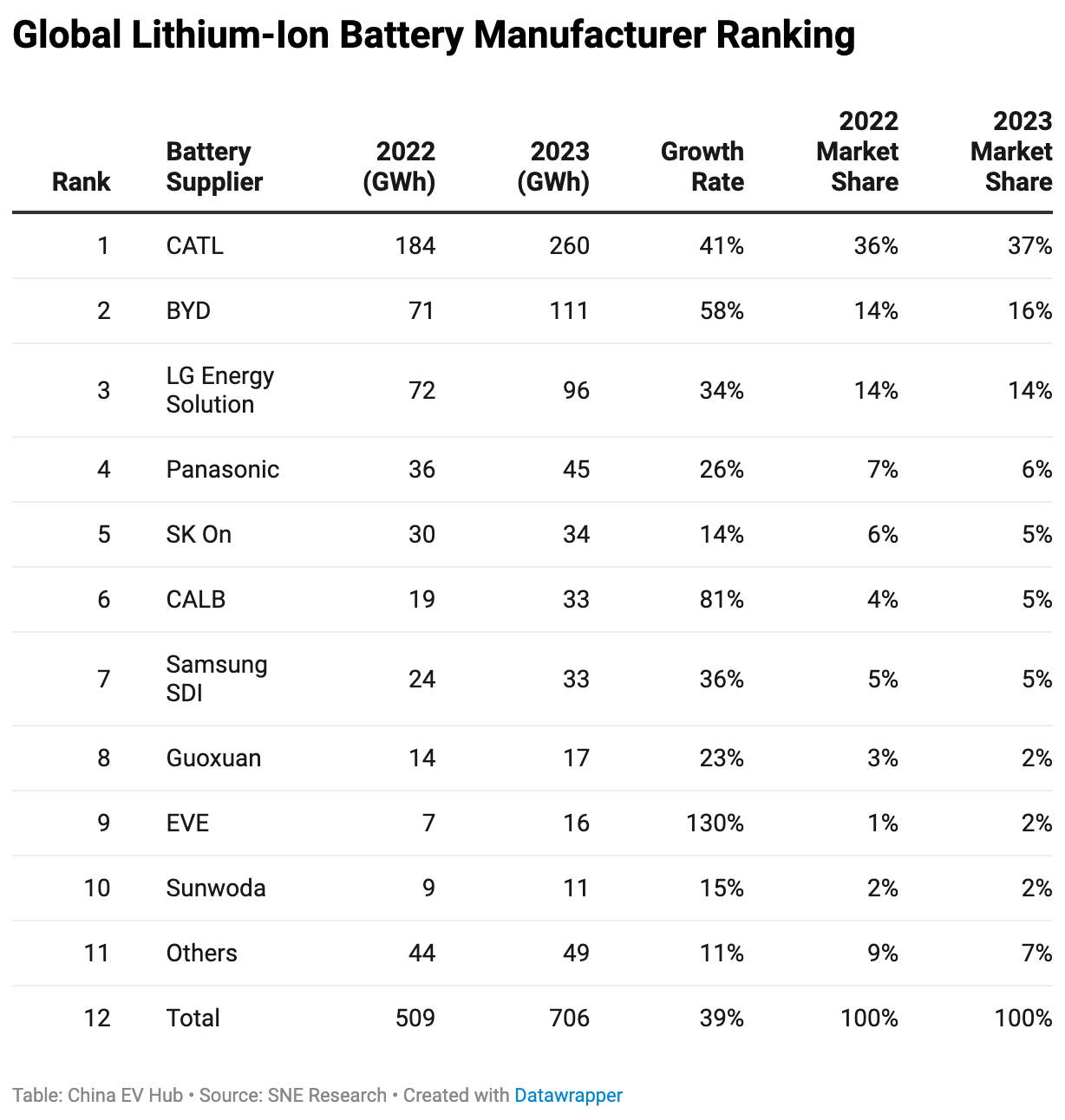

Despite the general decline in costs over the years, a significant price disparity persists between China and other parts of the world. This is not surprising, given that 75% of the global lithium-ion battery manufacturing capacity is concentrated in China, where economies of scale remain unrivaled.

However, this scale and cost advantage come with challenges. Overextending capacity beyond demand is unsustainable for manufacturers and detrimental to the industry.

There is a clear and obvious solution. On one hand, U.S. and European automakers are in search of more cost-effective batteries. On the other, Chinese battery manufacturers like CATL, with their competitively priced batteries, are exploring new growth and revenue opportunities. On paper, it’s a no brainer, but it’s by no means an easy path to walk. Given the strategic importance of the industry and entrenched interest, many groups will have to come together, find common ground, and compromise. In many ways, the collaboration between Western OEMs and Chinese battery makers is set to dictate the pace at which affordable EVs become prevalent on roads across Europe and America.

Bridging the Gap: The Demand for Affordable Electric Options

The electric vehicle market is at a critical point, with demand in Europe and America centering around more budget-friendly options. The ideal price point appears to be around $25,000, a figure that could significantly accelerate EV adoption. However, this poses a considerable challenge for traditional manufacturers like Ford, GM, VW, BMW, and Mercedes, who need to develop strategies that make EVs competitive and profitable compared to their internal combustion counterparts.

This drive for competitiveness has led these legacy automakers to forge strategic collaborations, notably with CATL. The Chinese battery giant has not only emerged as a key supplier but also as an essential technological partner. According to SNE Research, CATL holds a 37% market share in 2023 and has become the world’s largest battery manufacturer.

But make no mistake, CATL also needs these foreign automakers as much as these automakers need CATL.

CATL’s Facing Stiff Competition In China

Two years ago, CATL wielded considerable bargaining power due to its advanced battery technology and capacity, attracting top automakers who were eager to secure substantial orders—some amounting to hundreds of gigawatt-hours—to ensure their supply lines.

Today, they are faced with excess capacity in China and a shrinking technological divide with other emerging battery manufacturers. Its portfolio of BEV customers like NIO, Xpeng, Avatr all had a tough year and didn’t meet their sales goals. Aiway, the EV startup CATL first invested in back in 2021 (link), is nearly bankrupt.

The segment that did grow quickly is PHEV/EREV, but CATL doesn’t have a strong foothold there. In contrast, it’s the smaller battery manufacturers, like Honeycomb Energy, that have successfully capitalized on the growing market. Last year, Honeycomb Energy's installed capacity in the PHEV segment saw a dramatic increase of 409% year-over-year, with shipments exceeding 400,000 battery packs. It was able to attract orders from Geely’s Galaxy, Dongfeng’s Voyah, GWM’s Tank & Li Auto.

There is also another elephant in the room, BYD. In the past 5 years, BYD has gained significant consumer traction with its DM-i and blade battery technologies. In 2019, BYD sold just 229,000 NEVs (includes both BEV and PHEV). In 2023, they sold over 3 million. In addition, BYD's ability to independently supply batteries globally poses a significant threat to CATL's market share.

Amidst the intense competition domestically, CATL is turning to international markets for expansion, hoping to secure long term partnership with foreign automakers before others gain a foothold.

Factory Buildout In Europe

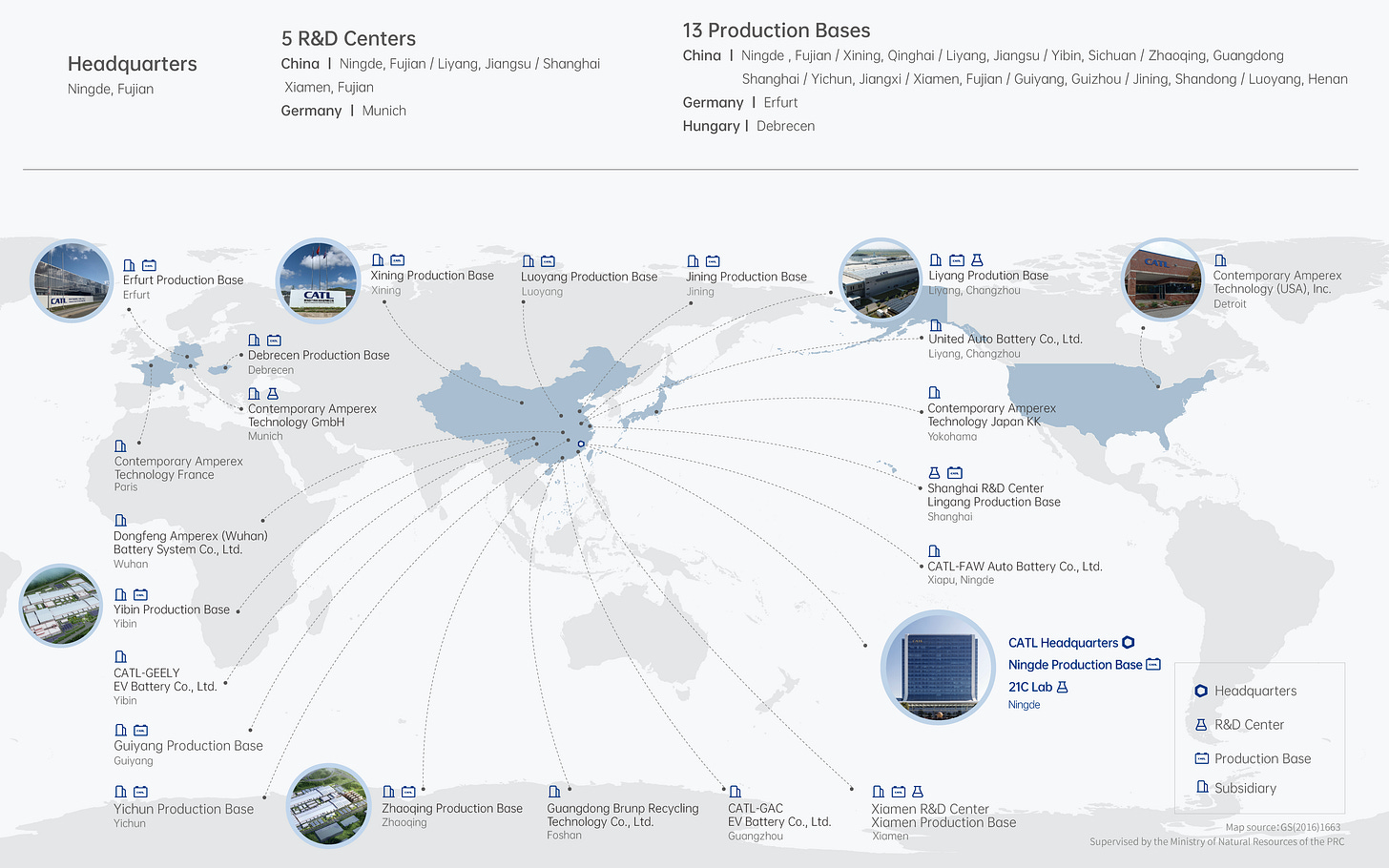

In Europe, CATL's strategy is straightforward: build factories, lots of them. This is the most expensive, but also the fastest way to enter a new market. In the region, CATL will provide both technology and initial capex in exchange for long-term battery supply agreements from OEMs. Today, this is happening at a modest scale. The company began local production in their Erfurt, Germany plant. It first started as a module assembly facility in 2021 and transitioned to cell production by the end of 2022. The original capacity of 8 gigawatt-hours (GWh) per year has since expanded to 24 GWh. Despite this increase, capacity still falls short of meeting the demand in Europe.

A second facility, with a capacity of 100 GWh and costing $7.5 billion, is under construction in Debrecen, Hungary. It is expected to commence operations in 2026. Discussions are ongoing to establish the third (link) and fourth (link) European factories in partnership with various OEMs.

Partnership in the U.S.

North America represents another key market for CATL. However, the same model used in Europe faces geopolitical challenges in the U.S. Previously, CATL did consider establishing a battery plant in the region to quickly begin operations and assist OEMs in qualifying for EV tax credits. The plan was likely similar to Europe’s initially. Build plant quickly for pack assembly, and then add production equipment and expand to cell production. But in either case, they’d be using materials from China.

However, strict material sourcing requirements introduced by the Inflation Reduction Act (IRA) have rendered this strategy unfeasible. The full explanation of how the IRA works is outside the scope of this post, but essentially EV batteries must have 40 percent of the critical minerals contained within them sourced from the US or its free trade partners to remain eligible for the tax credit. China is certainly not on the list right now nor will it be added in the foreseeable future.

Yet, not all hope is lost. Recently, a novel "License Royalty Service (LRS)" model has gained traction, where CATL extends its intellectual property rights, oversees construction of battery production lines, and manages manufacturing processes, while automakers cover the capital expenditures and retain full ownership of the plant. In return, CATL simply charges a patent licensing and service fees. This model has found favor with Ford, Tesla, and GM, exemplifying a new dynamic in battery production.

Ford's initiative in Marshall, Michigan, where it partnered with CATL for a battery factory, was the first to adopt this model (link).

Tesla's collaboration goes even deeper, involving the supply of battery technology and co-development of new battery chemistries for its Gigafactory in Nevada (link).

General Motors, too, has entered the fray with plans to acquire licensing for LFP battery technology from CATL, potentially leading to a joint venture factory in North America (link).

Weighing the Model: Prospects and Challenges of the LRS Approach

The License Royalty Service (LRS) model presents both significant opportunities and notable challenges across various stakeholders.

For CATL: The LRS model decreases investment costs and boosts profit margins by providing technical support and overseeing construction, while also reducing geopolitical risks. However, this model may limit CATL's revenue and profit potential as it transitions from direct sales to a structure dependent on one-time fees and continuous patent licensing. This shift could constrain long-term financial growth despite short-term advantages.

For Automakers: Constructing new battery manufacturing facilities is expensive, and the swift pace of advancements in battery technology poses a real risk. By the time a plant is operational, there is a chance that its technology may no longer be best in class, rendering the investment less effective in maintaining competitive advantage.

For U.S. National Interests: The LRS model facilitates the transfer of technology and manufacturing expertise back to the U.S., potentially bolstering domestic capabilities. However, the success of such a model hinges on consistent policy support over extended periods and across different government administrations. It also requires U.S. automakers to invest in robust domestic research and development in house rather than outsourcing these critical functions. This approach is crucial for maintaining technological leadership and ensuring the quality of locally produced innovations.

CATL's Global Strategy: Expansion Amid Challenges

Despite all these stated challenges, CATL's global expansion continues. Its leading position in the European market as the top battery supplier highlights its industry dominance. The partnership between CATL and American automakers illustrates the complex interplay between collaborative gains and competitive dynamics. The proactive and creative engagement displayed by both sides paints a hopeful path forward. In this intricate global dance, each forward step not only signifies progress for the companies involved but also represents a leap toward realizing the vision of making affordable, sustainable electric vehicles a mainstay on roads worldwide.