Li Auto's MEGA: A Tale of Ambition and Market Realities

Li Auto recently unveiled its first pure electric MPV model, MEGA, sparking a flurry of discussions and opinions. The launch event, held with much anticipation, highlighted not just a new product but also signaled Li Auto's shift towards a "dual-energy" approach, combining range extender (L7/8/9) and pure electric (MEGA) models.

MEGA is Li Auto’s first hand shake with the world in the BEV segment. It’s both a halo vehicle for the brand as well as a representation of the company’s ambition to lead in the premium EV segment.

Li Auto’s High-End Aspirations And First Foray Into BEV Segment

With a sale price of 559,000 RMB, LiAuto’s MEGA is certainly not a cheap vehicle. However, on paper, they certainly have the presence and “talking points” to back it up.

First, it’s a massive vehicle. With a length of 5.3 meters, it’s 30 centimeters longer than the Toyota Alphard, the most popular luxury MPV on the market today. It’s one of the very few passenger vehicles on the road where passengers in the third row genuinely wouldn’t feel cramped and uncomfortable.

Second, its design is futuristic and has been compared to a highspeed rail on the road. It’s attention grabbing everywhere you go. You’ll get noticed driving this more than any BMW, Mercedes, or Audi.

Third, Li Auto have designed the MEGA as a long range BEV from the ground up. This has afforded it a number of key technological advantage. For example:

The vehicle's aerodynamic efficiency is off the chart. With a notable drag coefficient of 0.215, it even compares to Tesla Model S's 0.208 in aerodynamic performance, despite it being a substantially larger vehicle.

Its charging performance is also stellar. MEGA is built on the latest 800V architecture. It co-developed a 5C battery with CATL, which can charge up to 520 KW and can provide 500 KM of range in under 12 minutes.

Both of these underscore Li Auto's commitment to leading the technology race with its first BEV platform and provide a competitive offering in the pure electric MPV market.

Interestingly, Li Auto doesn’t view MEGA’s competitors as just luxury MPVs. Liu Jie, a VP within the company, once gave an example in an interview: “Before the Alphard was introduced, there was no million dollar MPV on the market. Once the Alphard emerged, its users came from previously luxury mid-to-large cars, SUVs. We think Mega is a product that’s directly competing with traditional luxury brands. Our goal is to become the number one in sales above 500,000 RMB, regardless of energy type, regardless of body type"

To prepare for that goal, Li Auto spared no expense in its marketing effort leading up to launch. MEGA's launch was strategically orchestrated, with various marketing milestones keeping the public buzz alive months prior to launch. They hosted a number of high profile media and influencers in Sanya (a trendy beach town in southern China), and ensured everyone had ample time to review and test drive the vehicle over multiple days. They also pre-build a large number of test drive vehicles ahead of launch to they are available at all major store locations the same day as the product launch. It’s a very expensive strategy, but one that’s designed to maximize sales conversion and has worked very well with their past launches.

Lackluster Market Response and Consumer Feedback

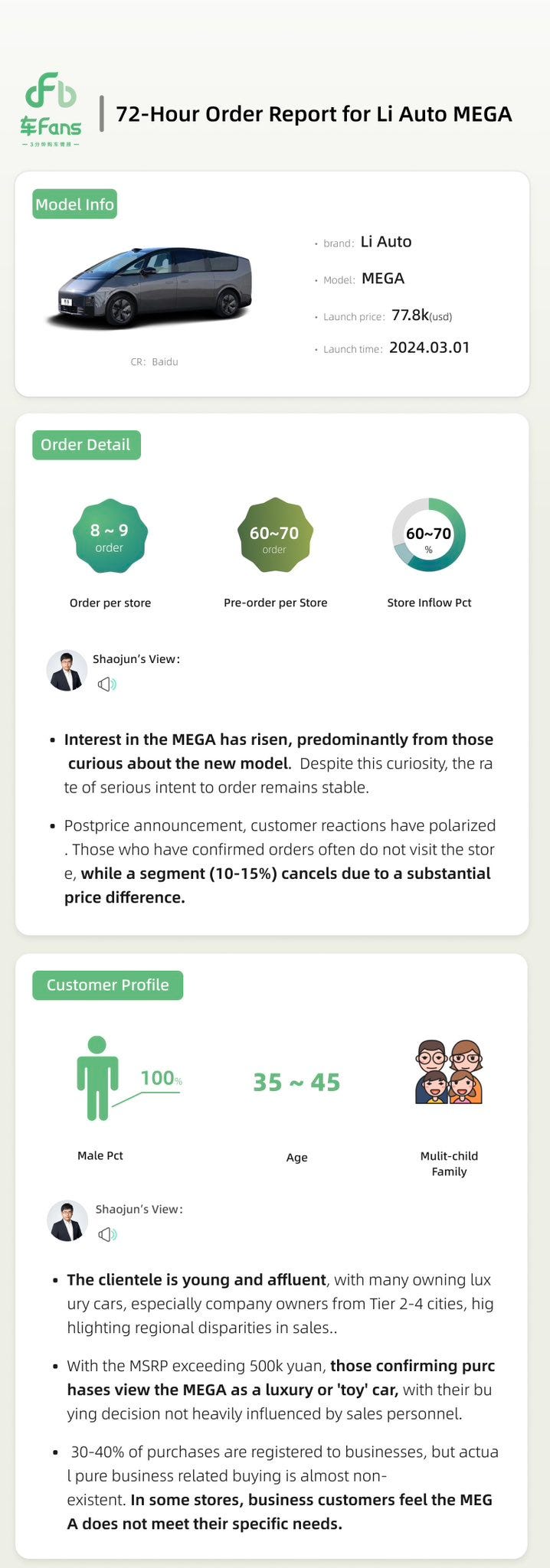

While all these investments, along with the charismatic Li Xiang (Founder & CEO) hyping it up ahead of launch, MEGA created a ton of buzz online and offline on the day of the unveiling. However, despite its best effort, MEGA's performance post-launch has been underwhelming, with sales not matching the anticipated levels. The initial sales data revealed that despite significant interest in test drives, actual purchase conversions were low. According to recent report from 36kr, conversion from test drive to order is < 10%.

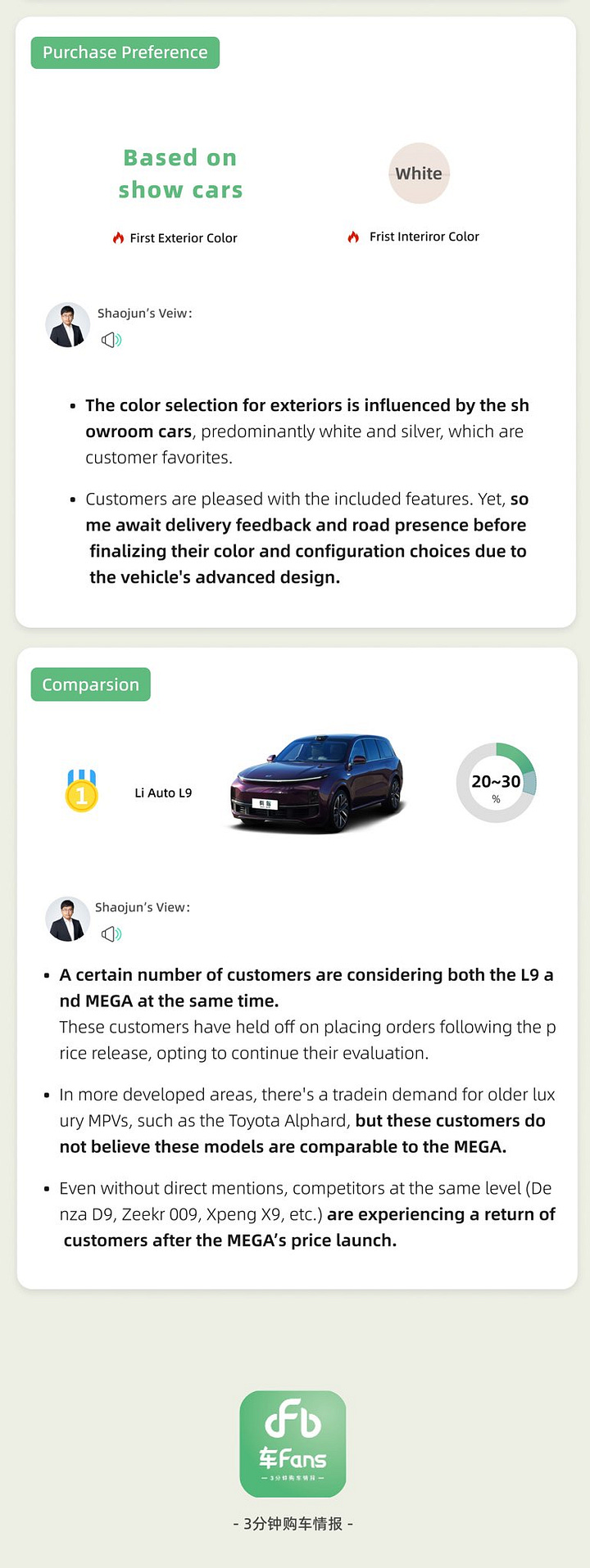

Consumer hesitancy appears linked to concerns over the vehicle's size, price, and the practicality of owning a large pure electric MPV in a segment that is not inherently large. The hypothesis that it’ll attract customers from other large SUV/sedan segments simply did not materialize.

Additionally, the perceived quality of MEGA's interior and design has been criticized, with some customers feeling that it does not live up to the luxury expected at its price point. It’s largely a replica of Li Auto L9’s interior, which is over 100,000 RMB cheaper. Many also compared the MEGA to Xpeng’s X9 and thought the X9 offered far more value for 200,000 RMB less.

According to Carfans 72 hours sales report, MEGA’s customers tend to be younger (35-45 years old), likely due to its futuristic design. However, the reality is that there really isn’t that many 35-45 year old with 600k RMB on their hand and is on a market for a 7 seater MPV.

The Path Forward

The journey of the Li Auto MEGA illustrates the complexity of entering and establishing a foothold in the high-end EV market. While MEGA's technological attributes and strategic market positioning are clear, the consumer response underscores the need for a more nuanced understanding of market dynamics and buyer preferences. The company's ability to adapt and refine its offerings in response to market feedback will be critical in achieving its ambitious goals.

In my opinion, there are 3 clear challenges that Li Auto needs to overcome:

Consumer acceptance of BEV is still developing. Selling BEV requires far more consumer education. Charging infrastructure buildout is also important.

The interior of MEGA was a clear miss & Li Auto will need to make adjustments here. Customers need to feel special sitting inside the vehicle.

Consumer preference in the 500k+ RMB segment is very different. Intangibles attributes such as brand image matters a lot more. Li Auto is still a young brand and its pricing power is still weak. It’s generally not considered a high end brand, even thought it sells expensive vehicles.

From product standpoint, the path forward involves addressing the concerns highlighted by potential customers, enhancing the perceived value of MEGA, and possibly adjusting its pricing strategy to better align with consumer expectations.

From an organization standpoint, they need to ensure they build mechanism to disrupt themselves. While BEV is undoubtedly the future, it’s also a segment that require substantial higher upfront investment and infrastructure development. Since inception, Li Auto have largely avoided those investments by choosing a niche customer segment (large family SUV) and technology roadmap (EREV). In the BEV segment however, they have to realize they are the challenger and need to earn their spot at the top in the market.

In conclusion, Li Auto's MEGA encapsulates the challenges and opportunities inherent in the high-end EV market. Balancing technological innovation with market realities and consumer preferences will be key to its success. As Li Auto navigates these dynamics, MEGA model will continue to be a significant indicator of the company's ability to achieve its vision of leading the premium electric vehicle segment.