Navigating the Road Ahead: A Look at NIO's Prospects in 2023

The first three months of 2023 have been very volatile for the automotive industry. Tesla kicked off the price war by announcing a sudden 15% price cut back in January. Then, on February 10th, BYD launched the Qin champion edition, a plug-in hybrid sedan priced just under 100k RMB (~15k USD). They are both launching full-on assault against ICE vehicles built by legacy automakers. EV startups like NIO, Li Auto, and Xpeng are also making massive investments into new models, technologies and infrastructure to ensure that they have a seat at the table as competition continues to level up.

The companies that are able to successfully navigate this critical juncture will become the primary beneficiaries as the industry inevitably consolidates over the next 2-3 years.

This is a 3 part series talking about the key challenges that NIO, Li Auto, and Xpeng have to overcome respectively. For today, we’ll start with NIO first.

2022 Recap

NIO didn’t have a bad year in the traditional sense. In 2022, they launched three new models based on NT2.0 platform (i.e. ET7, ES7, and ET5). NIO delivered a total of 122,500 vehicles in 2022, a year-on-year increase of 34%. However, they fell short of their own targets, and did not keep pace with the overall industry growth (NEV market grew 90% YoY)

While they were struggling with quality and supply chain issues, Li Auto kept racking up new sales record month after month. Li Auto ended up delivering 133,200 vehicles in 2022 and in Q4 and was the first EV startup to achieve 20k+ sales in a single month. Furthermore, while NIO's average unit price per delivery decreased to 368,500 yuan due to the delivery of ET5, Li Auto average unit price was 372,800 yuan in Q4 2022, surpassing NIO not only in deliveries but also in revenue and profit.

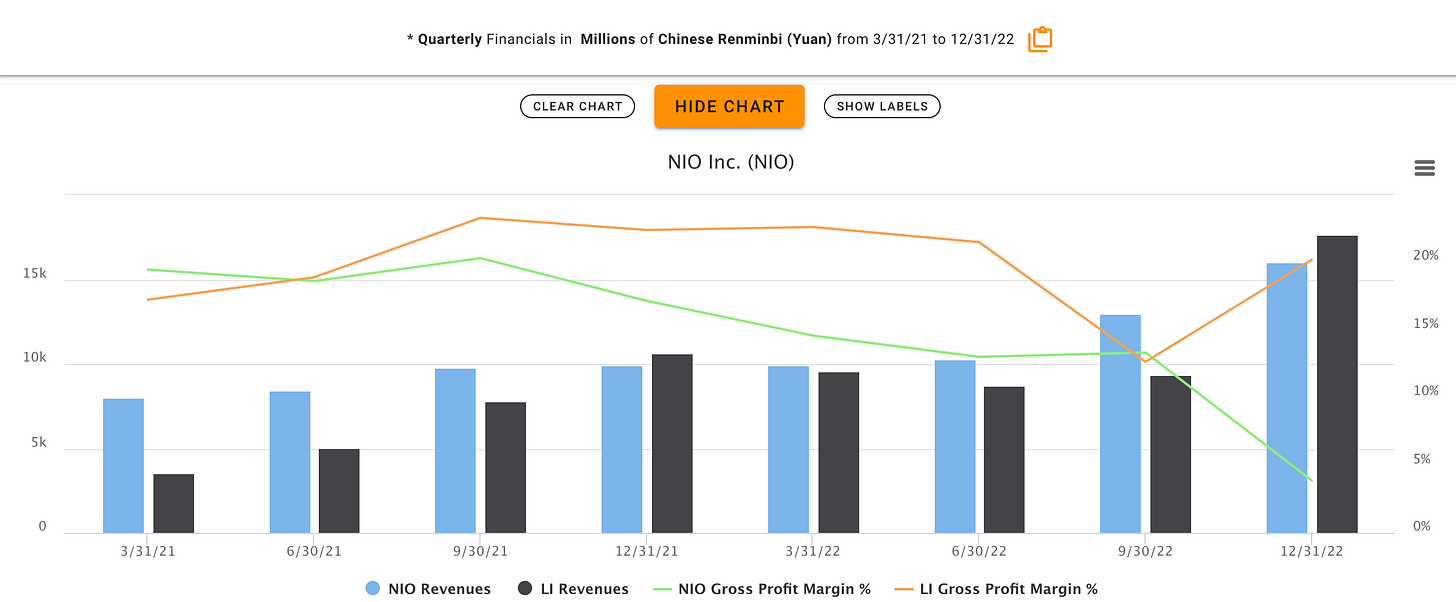

NIO's automotive gross profit margin in 2022 was 13.70%, compared to 20.06% in 2021, a year-on-year decline of 6.36 percentage points. In comparison, Li Auto’s annual automotive gross profit margin only decreased slightly from 20.57% to 19.09%

William Li (Founder & CEO of NIO) was candid in his "Internal Reflection Letter" on the first day of 2023:

"In 2022, we had both hard work and accomplished many things, but we need to be clear-headed and realize that many of our peers performed better than us during the same period."

He directly pointed out 8-9 key issues, mainly targeting the issues with early deliveries of ET7 and supply chain issues during ET5 deliveries. This not only affected the overall delivery cadence for 2022 but also impacted ET7’s reputation as the flagship model for NT 2.0. It also made it more difficult for ET5 to achieve its objective and surpass BMW 3 Series monthly sales.

Although William Li expressed confidence during the Q4 earnings call that NIO's vehicle gross margin would return to the 18-20% level, that’s really a baseline for an automotive OEM to be sustainable. The gross margin needs to be higher than traditional OEMs due to the additional sales & delivery expense the OEM have to digest by also being the dealer. Li Xiang (Founder & CEO of Li Auto) recently said the same thing on Weibo.

NIO’s challenge in 2023

NIO's biggest challenge in 2023 is the completion of their product refresh. The refresh of their aging “866” lineup is critical in order to return to growth. Sales for those 3 models have declined significantly starting in Q4 and only staying afloat in Q1 due to heavy discounts on existing inventory. Recently, there were multiple rumors that NIO is selling their older models through supplier channels at a 20% - 30% discount, indicating the enormous sales and pricing pressure that NIO is facing. This ASP and gross margin pressure will reach its peak in Q1 2023

The competition is also intensifying in the 300,000+ RMB segment as well. The same-sized iM LS7 is priced below 400,000 RMB. The new AVATR 11 single-motor variant is priced as low as 319,900 RMB and has bigger battery / better range. BYD is also launching their new Denza N7, which will compete directly in this segment. All these new models are highly competitive, and pose a significant challenge for the new ES6.

2023 is also the first year we’ll get a glimpse into how big of a moat is NIO’s battery swap network and premium brand/service for the company. They have indicated strongly they will not compete on price, but instead continue to invest in their battery swap and service network to give their customers a better experience.

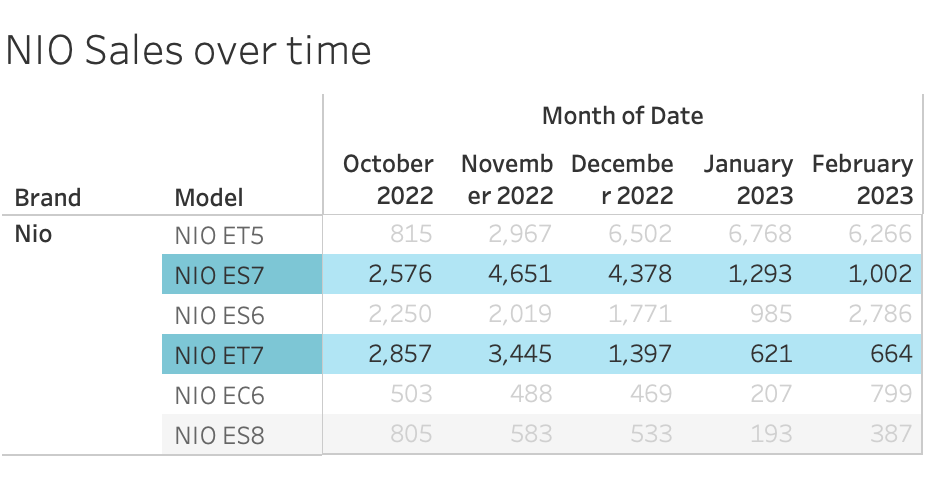

This is very admirable and I respect them a ton for sticking to their values. However, the reality is in today’s environment, price is the most direct way to impact a customer’s purchase decision. Having worked in automotive retail, there are a lot more people who say they want great service/experience than there are people who is actually willing to pay up for it. ET7 and ES7 are good representations of this phenomenon. So far in 2023, sales for both models are down 50-75% QoQ, despite them being on the new NT 2.0 platform. I think what’s happening is that the number of people who is willing to pay a premium for NIO’s brand and service is finite, and for those people, they can enjoy the same service regardless of whether they buy the entry level model of the most expensive one. Therefore, you see a significant concentration of orders in the ET5.

I would expect things to get better once the new ES6 launches. I’ll be especially interested to see NIO’s pricing strategy for the new model next month given the new market environment. The old one currently starts at 386,000 RMB. Personally, I think that’s too high to hit their 10k monthly sales target. If NIO wants to reclaim the top spot in premium BEV sales, I think they have to lower the price to ~350,000 RMB, but that obviously has big implications from a gross margin standpoint so they’d also have to do a cost down exercise.

In 2023, both ASP and gross margin will likely trend downwards as lower priced variants ramp. It’ll be a serious problem if these reductions do not lead to an commensurate increase in sales volume and operating leverage. In a nutshell, that’s the homework that NIO have to ace this year.