Navigating the Road Ahead: Can Li Auto Disrupt Themselves in 2023?

For Li Auto, transition to pure electric is the real challenge

This is the 2nd part of a 3 part series where I take a look at the key upcoming challenges for the 3 Chinese EV startups (NIO, Li Auto, and Xpeng)

Part 1 was about NIO, which you can read by clicking the link below.

2022 Recap

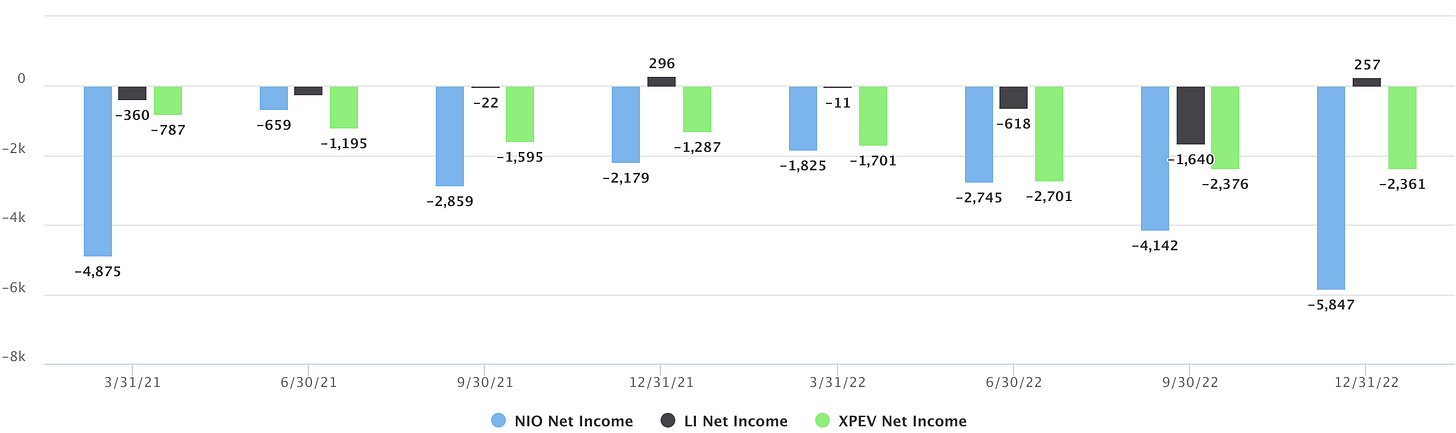

2022 was a banner year for Li Auto. Historically, they have always been relegated to 3rd place among the three Chinese EV startups (NIO, Li Auto, Xpeng). This is because Li Auto chose to exclusively focus on extended range technology early on instead of pure electric. Many viewed this as a technological dead end and investors did not put a high value on its future. However, Li Auto so far has proved all their doubters wrong, including myself.

Thanks to their precise product positioning (a do-everything vehicle for the modern Chinese family) and world-class execution navigating through Covid shutdown, Li Auto has surpassed both NIO and Xpeng in sales volume, revenue, and gross profit in Q4 of 2022. Additionally, Li Auto’s market value now exceeds that of NIO and Xpeng altogether.

In 2022, Li Auto also transitioned to their 2nd generation platform and expanded from one model (Li Auto One) to three (L9/8/7). Their new generation of vehicle is also more premium than before, with prices ranging from 328,000 RMB to over 450,000 RMB. In fact, Li Auto’s ASP is the highest among the 3 startups now. The average unit price of its vehicles also increased by 27%.

Despite the higher ASP, they achieved the highest monthly sales volume, and became the first EV startup to surpass 20,000 monthly sales in Q4.

Most importantly, they achieved quarterly profitability again in Q4 of 2022, with a profit of 257 million RMB.

Late last year, Li Xiang (Founder & CEO of Li Auto) posted on Weibo that Li Auto aims to achieve monthly revenue of over 10 billion RMB in 2022. When the L9 and L8 models are delivered at the same time, it will mark the end of seven years of loss-making operations. That milestone has been met with resounding success. With the introduction of the L7 5 seater SUV, it would not be surprising for sales to reach 30k units/month.

Li Auto’s Challenges in 2023

Looking ahead into 2023, Li Auto’s focus will shift to pure electric vehicles, starting with an family MPV. Their first product is a pure electric MPV, codenamed W01. How they choose to differentiate against their competitors in this segment and whether this sub-market is big enough for everyone are both big question marks. Currently, there are only five pure electric MPV products on the market priced over 250,000 yuan. Among these products, only Zeekr 009 is expected to sell at a meaningful volume. Sales of pure electric MPVs are much lower compared to their plug-in hybrid counterparts. For instance, since March, the insured vehicles for the pure electric version of the Denza D9 accounted for only 10.85% of all D9 sales.

This is because to date, pure electric MPV are pre-dominantly used for fixed routes and point-to-point business trips, such as one-way or round-trip travel from the airport to a hotel. When it comes to family long distance road trips, range anxiety is still very real.

The only way to solve this long term is to build more charging stations. However, Li Auto has under-invested in this area to date, so they are probably 2-3 years behind their peers in terms of deployment. To catch up, there are 2 main challenges that Li Auto have to overcome:

Convenient locations for charging are finite, and both NIO and Xpeng have had a big head start compared to Li Auto.

DC fast chargers buildout will run into power capacity issues. Majority of sites today is only approved for about 630 kW of power. Increasing power output required to handle future 500 kW fast chargers will need significant capex (either in upgrading the grid or adding battery storage on-site). These issues add significant engineering complexity to the buildout.

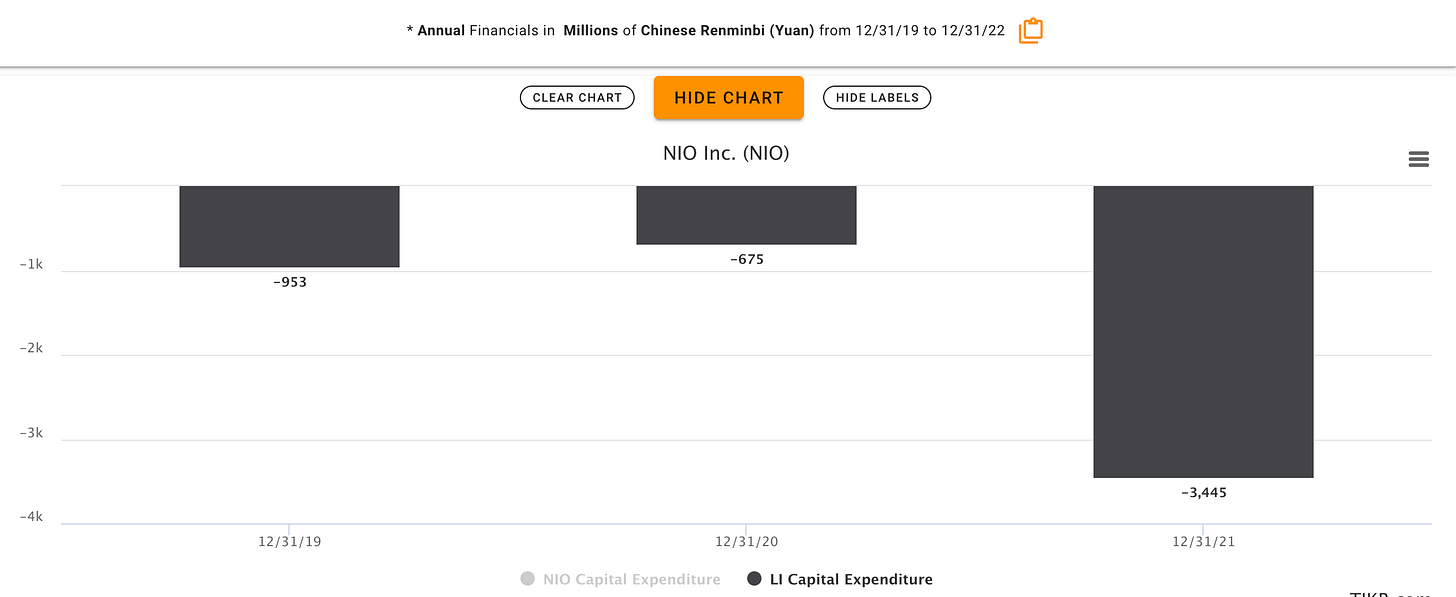

To accomplish the above, it’s not only a big operational/engineering challenge, but also requires heavy capital investments. I estimate this amount to be ~10B RMB over the next 3 years alone. This alone is already 2x what they have spent in total CapEx for the previous 3 years.

In many ways, because Li Auto have been so successful to date with their EREV technology, they are now in a bit of an innovator’s dilemma of their own.

Should they spend the billions of dollars we need to build out this charging infrastructure?

Wouldn’t the $$$ not be better spent continuing to invest in making EREV technology even better? or to accelerate progress in autonomous driving, an area they are also lagging behind?

In my view, if Li Auto is serious about becoming a leader in the pure EV segment, they also have to get serious about charging. Can Li Auto push through the internal resistance and commit the capital and resources required to make this successful? That is still a question mark today. If they can successfully overcome these challenges, Li Auto will have a brighter future; otherwise, 2022 might be their 5 minutes of fame.