Navigating the Road Ahead: Is 2023 XPENG's Darkest Hour?

This is the last part in a 3 part series exploring the 3 Chinese EV startups. You can read part 1 (NIO) and 2 (Li Auto) in the link provided. Today, this post is about XPENG.

XPENG, regarded as one of the top three Chinese EV startups, suffered the most in 2022. Although the P7 model was the top-selling vehicle among the three in the beginning of 2022, sales dropped sharply by the end of the year. The failed launch of the G9 also added salt to the wound. As a result, sales were surpassed by Li Auto and NIO, despite XPENG having the lowest ASP of the three.

XPENG’s trouble in 2022

The main reason for XPENG’s underperformance can be traced back to their disastrous G9 launch. The model was a highly anticipated one, especially coming off of the success of the P7. However, when launched, the interior was too bland, BOM cost was too high and the product SKU was too confusing. The root cause of these issues is a overall lack of understanding on who their customers are and what they want.

Let’s do a deep dive on each of these issues:

Interior

First, on interior, this one is a bit subjective, but you can see that the G9’s interior is a big departure from prior models. It’s a lot more mature and adorned with traditionally luxurious materials, since it’s a more expensive vehicle. While it’s not bad, it’s not what you’d call inspiring, particularly for a company that’s known to be tech forward.

This is especially apparent when compared to L9’s interior by Li Auto

BOM Cost

Second, on the cost side. XPENG actually didn’t skimp here. They genuinely wanted to make a great product with technological innovations. However, while these innovations are great engineering feats, they add very little values to customers’ day to day at this time. So it’s difficult for most people to justify the cost.

For example, XPENG is the first Chinese OEM to adopt the 800v architecture on the G9. This allows the vehicle to charge from 0 - 80% in just 15 minutes. However, while the vehicle is theoretically able to handle such charging speed, the charging stations that can output this kind of power are few and far in between (there are only 186 as of April 03, 2023).

The same is true for semi-autonomous driving as well. The G9 boasts impressive hardware (2 lidars, 14 cameras, 5 millimeter-wave radars, 12 ultrasonic sensors + 2x Nvidia DRIVE Orin chip). But the reality is, when evaluated on its current capabilities, it’s not that different from basic L2 functionalities. As a result, very few people are willing to pay a premium for this right now.

As a result, in Q4 2022, XPENG was only able to achieve an automotive gross margin of 5.66%. This is even lower than NIO's gross margin after accounting for the depreciation of their old models. No company can survive on this type of gross margin.

Product SKU

The last problem I want to highlight is G9’s complex SKU on launch. In many ways, this is most illustrative of the issues that XPENG is facing as an organization today.

Below is a configuration chart of the various trims and options at the time (Translation provided). Immediately you can see how confusing the whole thing is:

The G9 had 6 trims. That’s a lot and added significant complexity and confusion for their customers. The price points for the different trims were also not equally spaced out.

On their base model, It didn’t offer the necessary hardware that enabled even basic NGP (their semi-autonomous driving functionality). For their flagship model that’s supposed to be the halo vehicle for the entire brand, this choice was puzzling.

On the top end, the G9 offered a launch edition called the 650X. It also offered an option called “4C Fast Charging Pack” that allows the vehicle to fully leverage its 800V architecture and charge 200 KM of range in just 5 minutes. However, if you wanted the top of the line signature edition, this option is actually not available.

There are many more issues that I can go on and on about, but these 3 are the most egregious. When the G9 initially unveiled, I just couldn’t understand what the product planning team was thinking. It seemed like a set of configuration options created by a committee of engineers, each with his/her own agenda and nobody asked who their customers are or what they actually want. In many ways, it’s reflective of XPENG’s culture internally.

If I were to speculate, the misunderstanding likely stemmed from the initial success of the P7. XPENG thought people bought the P7 because of its software and intelligence. Its self-driving tech (NGP) and voice-controlled infotainment were certainly class leading at the time. But in reality, P7 simply sold well because it had a sexy design, long range, and more luxurious interiors than the Model 3 (its main rival). Most importantly, it was affordable (240,000+ RMB). Management thought people liked the P7 because of her brains, but in reality they liked her because of her pretty face, nice ass and approachability. This misjudgment ended up costing XPENG dearly. Sales of the G9 peaked just shy of 4000 units in December and then cratered like a rock since the new year.

In my opinion, XPENG G9 models should have been made into three trims:

The entry-level trim should have a small battery and rear-wheel drive for the budget conscious

The medium-equipped model should have a large battery and rear-wheel drive for people that want the longest range

The high-end model should have a large battery and four-wheel drive for people that want max performance

Semi-autonomous hardware should come standard on all trims, but can be software enabled. Other features such as the 5D sound system, air suspension, and wheel hubs can be offered as optional upgrades.

XPENG’s Challenges in 2023

When compared to NIO and Li Auto, I think XPENG’s challenges are the most daunting to solve, because they are deep rooted and structural within the business. XPENG’s founder & CEO He Xiaopeng has publicly admitted their missteps and made some significant moves recently to restructure the org. However, we likely wouldn’t see the full effect of those decisions until the next-gen platform. This is because all products that are launching this year were defined and developed three years ago. It’s practically impossible to change direction drastically at this point.

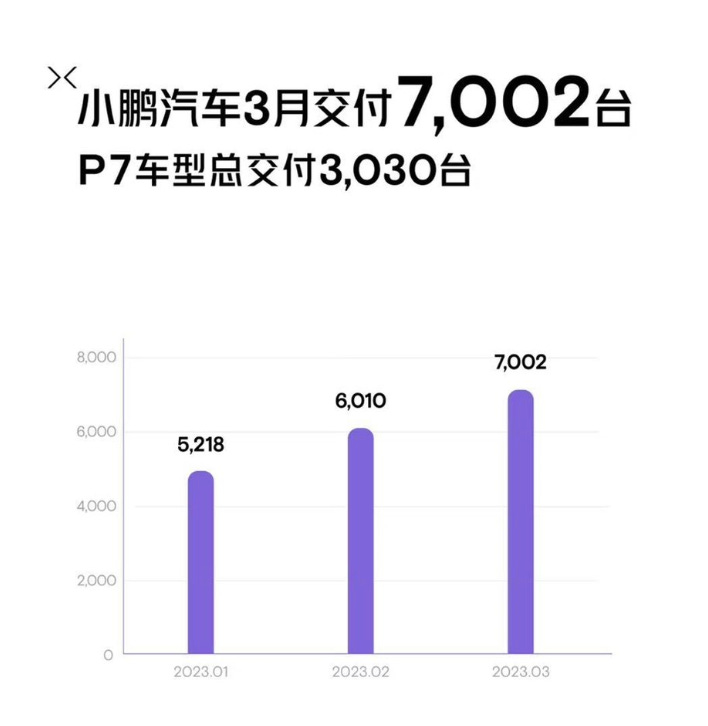

For now, they have to endure and try their best to salvage the situation. The refresh of the P7 was a good start and have stopped the bleeding for now. While there’re no major visible changes to the vehicle, a lot of incremental improvements were made and the P7i today is a much more refined product than before.

In addition, XPENG still have a great brand, particularly when it comes to autonomous driving and smart cockpit. While the advantage isn’t as big as it was 2 years ago, people still associate XPENG with being technology forward, just like how people associate Li Auto with family and NIO with battery swap / white glove service. While customers may not be willing to pay a premium at the moment, it’s a core part of XPENG’s DNA and they cannot afford to lose that identity.

The work is cut out for them. XPENG has 2 new models launching this year, the G6 (mid-sized SUV) and the H93 (yet to be unveiled MPV). The G6 will likely sell between 250k - 350k RMB, so not only does it have to contend with the Model Y, but also a number of new competitors entering this market, (BYD Sea Lion and Deepal S7 are two of the most anticipated).

Not much is known about the H93 yet except that it’s an MPV. This segment is historically both a niche and competitive market. I’d be curious to see how XPENG plans to differentiate their product with others in this segment.

For this year, XPENG is need to stay above water and maintain scale. They have enough cash to survive this downturn (31B RMB at end of 2022), but they have to make sure sales doesn’t get worse. The automotive industry is a capital-intensive and scale-oriented industry. Once sales slow down and capacity utilization declines, everything will start to unravel. Key suppliers will participate more cautiously, and be less willing to invest with you. Some may even require "cash on delivery", further straining cashflow and balance sheet.

Darkest hour before dawn?

For XPENG, the current predicament may be its "darkest moment". To get a second wind, what they needs to do now is get back to the basics and continue iterating on their "Smart EV” products. Stay close to their customers, understand what they care about, and stay true to their values. They are certainly capable of turning this around, as we saw with the P7i refresh (orders saw a 30-40% MoM uptick since the revamp). They just have to find a way to replicate that magic elsewhere and show everyone that it’s not a fluke.