NIO’s Relaxed Confidence: More Than Meets the Eye

A in-depth look into key drivers for NIO as it prepares for new chapter of accelerated growth

At the Beijing Auto Show this year, William Li was a busy man. He hosted top political figures like Wan Gang and mingled with other EV founders such as Lei Jun, Li Xiang, and He Xiaopeng at each other’s booths. In one interview, when Li Xiang lamented that premium BEVs are hard to sell due to lack of charging infrastructure, William playfully suggested to Li Xiang that he should consider joining NIO's battery swap network. When there was a moment to spare, Li Bin even found time for a karaoke session with Wang Feng, a renowned Chinese singer, showcasing a relaxed confidence that was noticeably absent in previous years.

Slower Growth Than Expected

On the surface, this seems odd. While NIO’s sales volume still grew modestly in 2023 to 160k deliveries, they missed their original sales target 200k+ by a significant margin. Overall EV adoption in this premium segment has been much slower than expected.

Furthermore, competition is more intense than ever in 2024. Unlike last year where NIO launched the brand new ES6, at this year's Beijing Auto Show, they have no new models to show outside of a mid-cycle refresh of the ET7, a high-end executive sedan. Other high profile updates, like the full-scale NOP+ rollout, or the launch of the new sub-brand Onvo, were all scheduled for later.

Author note:

I previously wrote a post on NIO back in 2023. Looking back, my observations about them last year were largely correct. In 2024, despite the heightened competition, I have a much more positive outlook on the brand. If they can execute well, end of 2024 can become a major turning point (for the reasons I list below). While not necessary, if you are new to NIO, it may be helpful to read last year’s article before continuing this one.

Brand Perception Still Lags Behind BBA

During a NIO user meetup with Li, one owner made a comment: "Driving a Mercedes symbolizes status without words; driving a NIO requires you to champion the brand." This observation sheds light on how legacy brands command inherent prestige, whereas newcomers like NIO must continually justify their place in the market. Another owner highlighted the regional disparities in brand acceptance, noting the stark contrast between the brand's visibility in metropolitan areas like Shanghai versus smaller cities.

To those pointed concerns, Li’s answer was simple: “be patient. The tide is about to turn.”

Product Competitiveness

The confidence isn’t unfounded from Li’s standpoint. Since launch, the ET7 has nearly 30,000 cumulative deliveries, affirming its stronghold in China’s luxury BEV sedan segment above 400k RMB. The latest refresh have also corrected many of the pain points existing customers have had over the past 3 years. The rear seats saw the biggest upgrade.

Sales & Promotions

In recent months, NIO seemed to have also found their rhythm on sales & marketing, introducing a variety of policies to stimulate demand without explicitly dropping price. Some of the most impactful changes to date are:

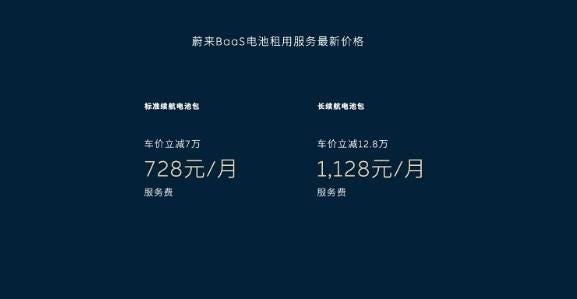

Adjustments of the BaaS pricing

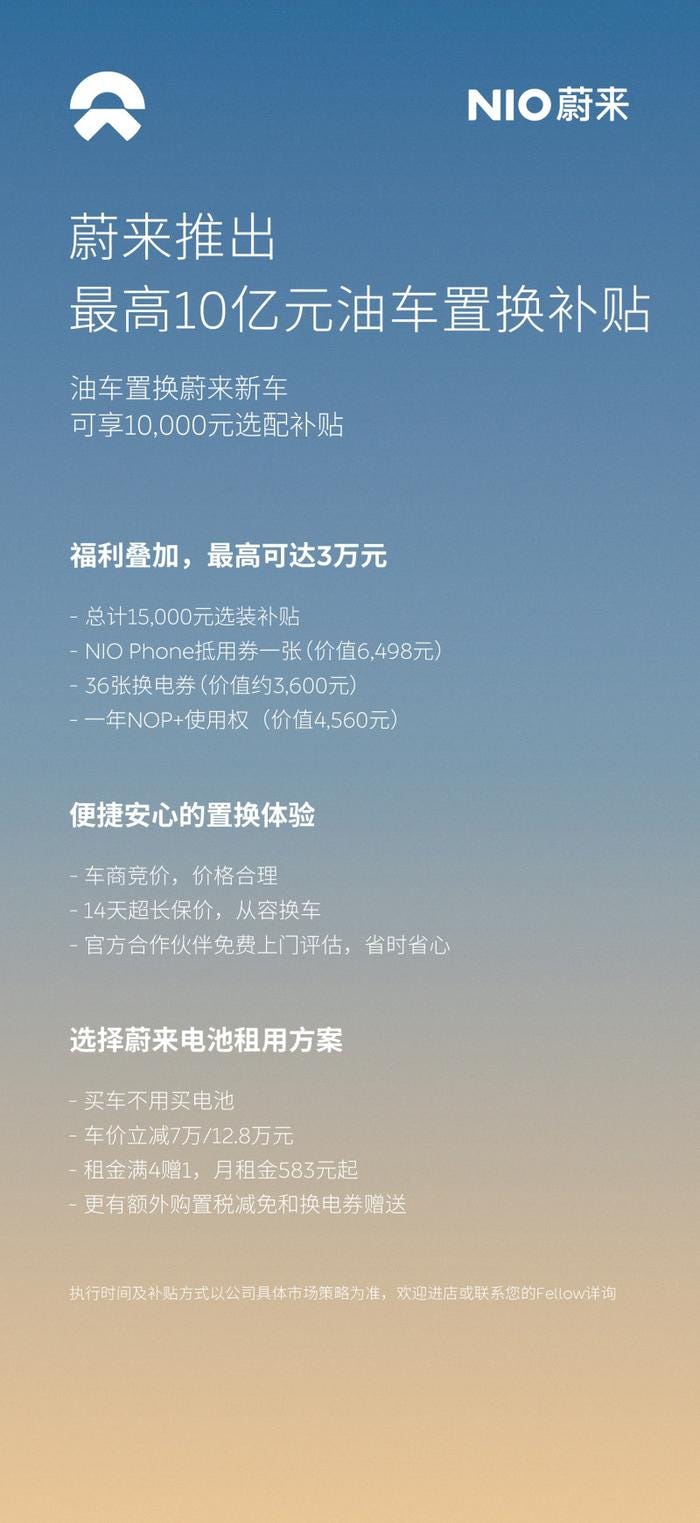

Launching a 1 Billion RMB subsidy for customers switching from an ICE vehicle to a NIO.

Reimbursing Xiaomi SU7 pre-order customers for their non-refundable deposit if switching to a NIO

As a result of these changes, despite the intense competition, NIO's in-store orders have seen an uptick in recent month, contrary to the downtrend experienced by its contenders. Competitors like Li Auto have faced challenges with their MEGA series, not living up to the high expectations set by their L series. Furthermore, other key players like Xpeng Motors have not managed to reach the10k monthly delivery mark since entering 2024, allowing NIO to maintain a solid performance with 10k deliveries in the high-end pure electric sector. So far, Zeekr is the only brand that’s able to go toe to toe with NIO.

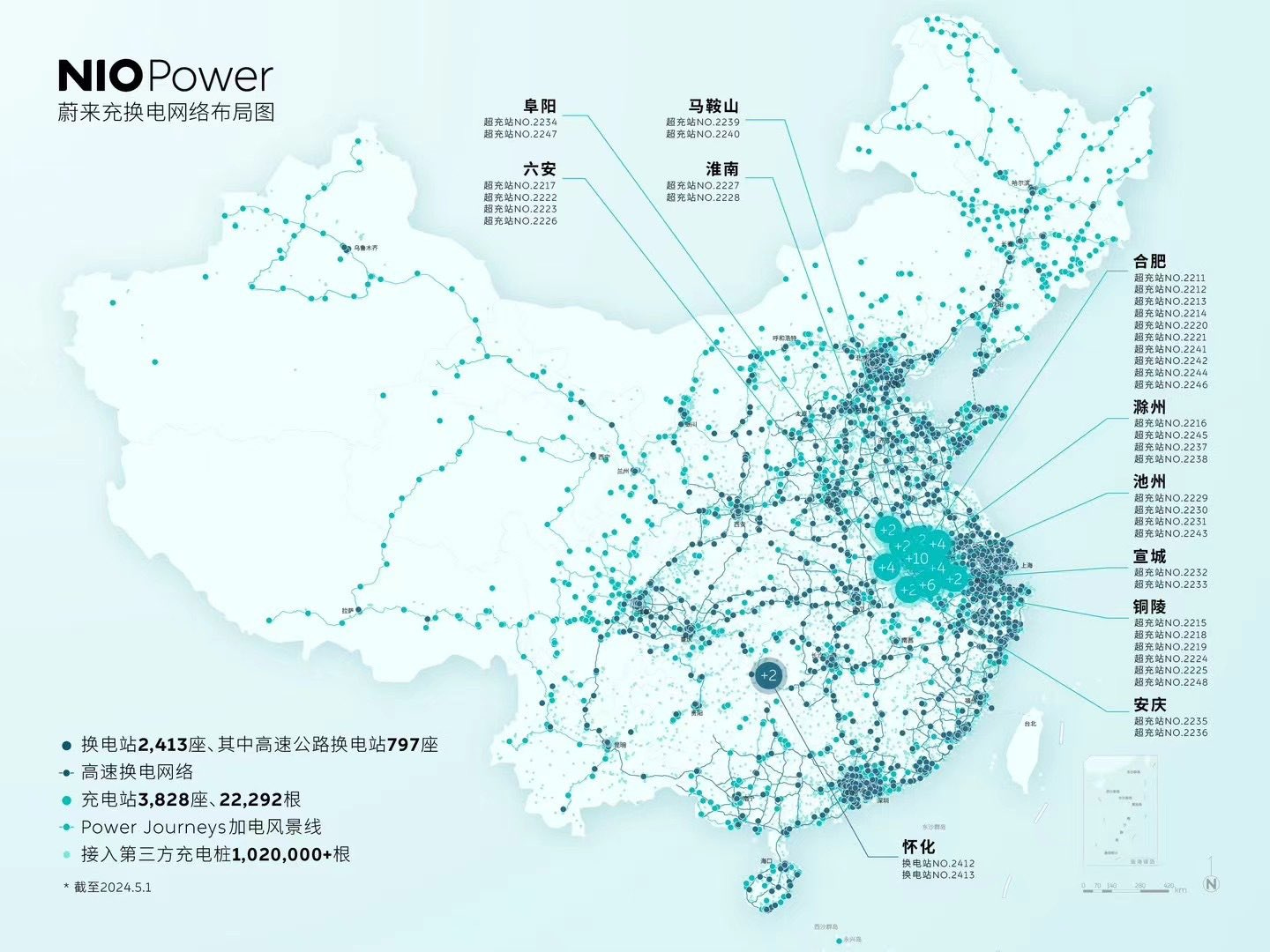

Infrastructure and Strategic Partnerships

Looking beyond the car, NIO’s heavy investment into battery swap and charging infrastructure is finally poised to bear fruit. With over 2,400 battery swap stations and 3,828 supercharging stations, NIO has laid a robust foundation that not only serves its current fleet but tempts other automakers into partnerships. These collaborations are not merely operational ventures but strategic alignments that could open new revenue streams for NIO down the line. Prior to the auto show, Geely, Changan, Chery and JAC have signed formal partnership with NIO. At the auto show, Lotus also announced that they intend to partner with NIO on both charging infrastructure and battery swap technology. We should expect battery swap capable models from these partner brands to come online in the next 18 months.

Onvo Sub-brand Launch

Additionally, the impending launch of the Onvo brand is set to push NIO into the much more lucrative, but competitive mass market BEV segment. This new brand, plans to leverage NIO's established strengths in its vehicle powertrain, swapping/charging infrastructure, and smart cockpit/autonomous driving. Their target is squarely fixed on the Model Y, the undisputed leader in this category.

On paper it’s a compelling entry. Based on existing report, it will have the following:

Battery: Offers a choice between a 60 kWh (BYD LFP) and a 90 kWh (CATL NMC) battery.

Energy Consumption: class leading efficiency at 13 kWh per 100 km, benefiting from vehicle 900V silicon carbide powertrain and a low drag coefficient.

Cabin: Equipped with an ET9-style horizontal screen, 8295 chip, and interior craftsmanship comparable to NIO, creating a mobile home experience. It’ll also have a fridge, tv, sofa like all the other popular models in this segment.

Charging: Access to over 2000 charging and 2000 swapping stations (ready upon delivery, compatible with third-generation stations). It’s also equipped with AC ports.

Price: Estimated starting price of 230k - 250k RMB for outright purchase, with BaaS (Battery as a Service), starting price should be closer to 170k RMB to 190k RMB.

Final Thought

It appears that NIO's strategic investments and the groundwork laid in previous years are now starting to bear significant fruit, propelling the company into a phase of accelerated growth and solidifying its position in the competitive EV market. The company's forward-thinking approach, particularly in infrastructure with over 2,400 battery swap stations and 3,776 supercharging stations, has not only enhanced its service offering but also positioned NIO as a desirable partner for other automakers.

As NIO continues to enjoy this momentum, it's crucial for the company to leverage its strengthened market position to convert prospects into loyal customers. This involves continuing to innovate in product offerings, maintaining a high standard of customer service, and effectively communicating the value and unique advantages of its EVs. With the introduction of the Onvo brand, NIO has a significant opportunity to tap into the mass market, further expanding its customer base.