Zeekr & Lynk & Co: A Strategic Reset for Geely

Why Zeekr-Lynk & Co merger sets a new bold course for Geely's new auto strategy

Zeekr recently announced its mergers with Lynk & Co in their Q3 earnings. I have been chewing on its implications, not just for the 2 companies, but also for the broader Geely group.

I think Geely’s recent decision to merge its two premium brands, Zeekr and Lynk & Co, is not just another round of corporate musical chairs—it’s a tide change for a conglomerate that once focused on brand proliferation. Now, with the Chinese automotive market awash in competition and riddled with overlapping product lines, Geely is taking a decisive step toward streamlining its operations. By consolidating these two brand powerhouses, Geely aims to eliminate internal rivalry and reposition itself to challenge industry giants like BYD and Tesla in a rapidly changing era of electrification.

Exposing Geely’s Past Strategy and Its Limitations

Nearly two decades ago, the company’s 2007 “Ningbo Declaration” kicked off an era of aggressive expansion. Geely’s approach—“more brands, more coverage”—proved effective in a growing market: Volvo, Proton, Lotus, London Taxi (LEVC), and numerous in-house brands were acquired or launched. From 2017-2021, Geely topped China’s independent passenger car sales five years running, thanks partly to its multi-brand strategy.

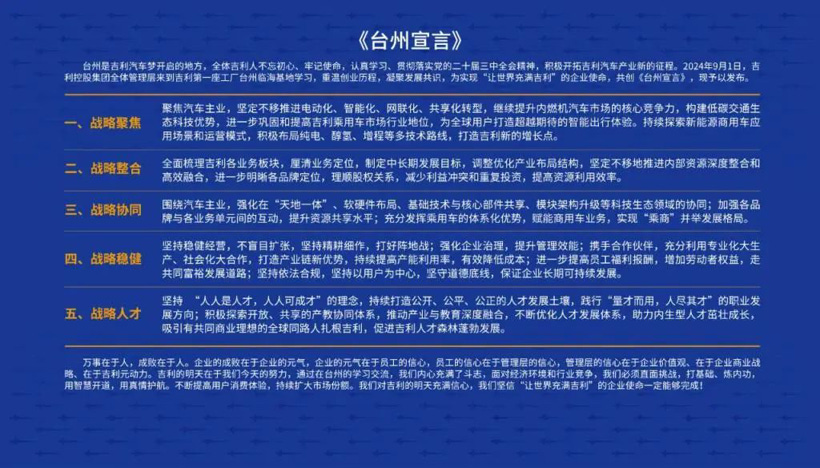

But the “Taizhou Declaration,” announced in September 2024, signaled a sharp pivot. Today’s environment demands a leaner, more focused approach. While once “not putting all eggs in one basket” made sense, now it’s threatening to become a muddle that dilutes brand identities and wastes R&D budgets. Faced with the rise of BYD as China’s EV leader and the intensifying global push toward electrification, Geely must recalibrate or risk sliding into irrelevance.

The Catalyst for Consolidation: Overlapping Missions and Products

Lynk & Co initially targeted mid-to-high-end segments, offering gasoline and hybrid models, and racked up over one million cumulative sales in just six years. Zeekr, born from Lynk & Co’s EV division, took a pure-electric premium route and soared to monthly sales of over 27,000 units in November 2024. Initially, these brands appeared complementary: Lynk & Co handled hybrids and high-quality combustion models, while Zeekr staked out the advanced EV frontier.

But by 2024, Lynk & Co also ventured into pure EV territory with the Z10 sedan, whose positioning overlapped with Zeekr’s offerings like the Zeekr 001. Meanwhile, Zeekr hinted at exploring range-extended drivetrains—territory Lynk & Co was already pursuing. This mutual encroachment created consumer confusion and internal turf wars, undermining Geely’s once-clear brand architecture. As one executive bluntly noted, if not integrated, these two brands would just keep on stepping on each other’s toes.

Minimizing Internal Turf Wars and Reducing Costs

This merger is designed to “reduce related-party transactions, eliminate internal competition, and deeply integrate resources,” as Zeekr’s management puts it. Without this step, overlapping R&D projects and competing supply chain contracts would continue inflating costs and eroding margins. Already facing a challenging market, Zeekr reported a loss of RMB 4.97 billion (about USD $691 million) in the first three quarters of this year, underscoring the urgency of cutting waste.

By merging Zeekr and Lynk & Co under one umbrella, Geely expects annual R&D spending to drop by 10%-20%, saving up to RMB 4 Billion (around USD $570 million) per year. Supply chain costs could fall by 5%-8%, and production efficiency could increase by 3%-5%. With combined sales of about half a million vehicles this year, An Conghui—President of Geely Holding, Chairman of Geely Auto, and CEO of Zeekr—believes the merged entity can soon hit the one-million annual sales mark, cementing its status as a leading high-end NEV (New Energy Vehicle) player.

Streamlining Technology and Enhancing Customer Experience

The merger also will allow Geely to deploy its best technologies more quickly and uniformly. Take the widely praised Flyme Auto infotainment system: Lynk & Co and other Geely subsidiaries adopted it, yet Zeekr lagged behind. Now, with the two brands integrated, expect a more agile rollout of cutting-edge features, from infotainment to battery systems and advanced driving assistance. Consumers win when internal brand silos vanish, making room for faster innovation and more cohesive product lineups.

In addition, the consolidation paves the way for clearer product differentiation, but specific details are still light. In theory, Lynk & Co will focus on the more “mainstream” compact and midsize market, while Zeekr will continue to improve its position in the premium market. Both brands will have BEV and PHEV in their lineup going forward. The idea is that when freed from the need to compete with each other, both can find niches that add value to the overall portfolio without confusing consumers.

Positioning for the EV Future and Brand Hierarchy

Geely’s endgame is a simplified brand ecosystem: Geely (including Galaxy, Geometry, Radar), Zeekr (now with Lynk & Co and potentially Polestar in the future), Volvo, and Lotus. Each will have a distinct role, whether targeting mainstream EV segments, premium electrified categories, global luxury markets, or ultra-high-performance niches. The clarity should help Geely invest more intelligently, respond to market shifts faster, and present a coherent face to consumers.

In this streamlined configuration, there’s no room for “internal arms races” that pit sibling brands against each other. Instead, the resources that once supported parallel R&D streams can bolster the entire group’s competitiveness.

Execution Risks and Cultural Integration

Automotive mergers are seldom tidy. Integrating teams, product roadmaps, dealer networks, and marketing strategies won’t be a walk in the park. Lynk & Co loyalists may worry about losing the brand’s distinct personality. Zeekr enthusiasts might fear that this integration will “cheapen” the brand. There are for sure internal politics and people challenges as well. Yet Geely’s leadership clearly believes the short-term turbulence is worth the long-term payoff.

With top executives like An Conghui set to manage both brands under one streamlined structure, the hope is to unify corporate culture and decision-making. Behind the scenes, supplier contracts, product engineering, and manufacturing footprints will be rationalized to get the most bang for every invested dollar.

Conclusion: A Blueprint for the Industry’s New Chapter

The Zeekr-Lynk & Co merger is the latest and boldest example of Geely’s transition from an era of sprawling multi-brand strategies to one of sharpened focus and strategic resource allocation. As China’s auto market intensifies and EVs reign supreme, this merger stands as a lesson for others: Convergence and specialization often trump expansion for expansion’s sake.

If executed correctly, Geely’s sweeping internal housecleaning will allow it to meet—or surpass—its ambitious goals, like hitting that coveted million-unit annual sales figure for high-end NEVs. More importantly, it sets a template for China’s other multi-brand automotive giants. When the market toughens and old models fail, the winners are those who can recognize reality and pivot quickly. Geely’s move could herald a smarter, leaner era of competition—one where fewer brands, clearer identities, and better execution carry the day.